The American Funds Target Date Retirement Funds Are A Top Pick for Retirement Savings

When it comes to saving for retirement, having the right investment strategy is essential for achieving securing your financial future. It’s like having the right game plan heading into the Stanley Cup Finals. Smart decisions now pave the way for victory down the road. For my money, the American Funds Target Date Retirement Series from Capital Group is a top contender for a spot in your retirement game plan.

Like all target date funds, these funds are designed to adjust their risk level and asset allocation as you progress through different life stages. What sets them apart is their proactive approach to managing two critical risks in retirement investing: longevity risk and market volatility. Think of it as having a coaching staff that adapts your lineup and playing style to counter the opposition’s strategy at each stage of the season.

Longevity Risk – Playing the Long Game

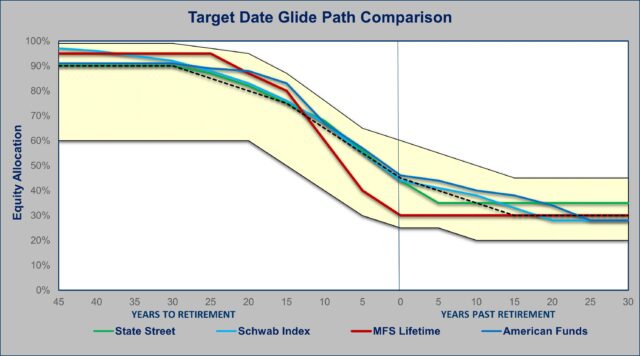

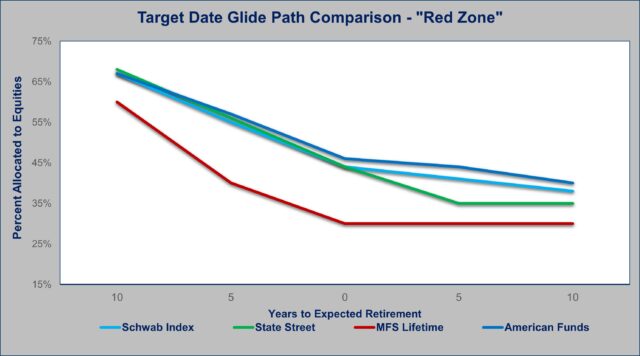

The fear of outliving your savings looms large in retirement planning. With life expectancy on the rise, a forward-looking investment approach is essential to stretching your retirement funds further. The American Funds Target Date Retirement Series maintains a significant allocation to growth-oriented equities even as retirement approaches. This focus on growth aims to combat longevity risk head-on. In contrast, some other target date funds adopt a more conservative stance, reducing equity exposure drastically near retirement. While this may lower market risk, it increases the danger of running out of money before your time runs out.

The ’Glide Path within a Glide Path’

What sets American Funds apart is their innovative “glide path within a glide path” approach. In addition to shifting between stocks and bonds, they actively adjust the composition of equity allocations as investors near retirement. During accumulation years, the focus is on capital appreciation through growth-oriented funds. As retirement approaches, the emphasis shifts to dividend-focused “growth and income” strategies. This versatile technique balances offensive and defensive positions within the equity allocation to increase income and lower volatility. This strategy aims to address longevity risk more effectively than just shifting from stocks to bonds.

Market Risk – Defense Wins Championships

Market volatility can disrupt even the most seasoned investors. The American Funds Target Date Retirement Series addresses this by making tactical adjustments to enhance stability as retirement nears. Equity exposure shifts towards higher-income assets like dividend-paying blue-chip stocks, while fixed-income allocations prioritize capital preservation with high-quality bonds. It’s a balanced approach that capitalizes on growth opportunities while safeguarding against market downturns. It’s an approach that blends offense and defense, allowing the funds to potentially capitalize on growth opportunities when markets are favorable while also providing downside mitigation when volatility heats up.

Building Depth Through Superior Asset Allocation

A key strength of the American Funds lies in their ability to construct robust portfolios from Capital Group’s extensive lineup of mutual funds. Like assembling a championship-winning team, they have access to standout funds across various asset classes and strategies. This depth allows them to construct well-rounded portfolios loaded with quality investments at every position.

Evaluating the Track Record

Beyond the appeal of the strategy, the American Funds Target Date Retirement Series boasts a track record of performance excellence. Consistently landing in the top quartiles for performance versus peer groups, these funds have delivered superior outcomes for investors over 3, 5, and 10-year periods. And all at a cost lower than any other actively managed target date series on the market.

Is American Funds Target Date Retirement Series for You?

While your options may be limited in your employer-sponsored retirement plan, you have the freedom to choose your investments in an IRA or Roth IRA. The American Funds Target Date Retirement Series is an excellent choice for investors with a long life expectancy who are comfortable with some market risk to mitigate longevity risk. However, if market volatility is your primary concern, stay tuned for my next post, where I’ll cover an alternative that might better suit your needs.