What Can An Investor Do About High Interest Rates?

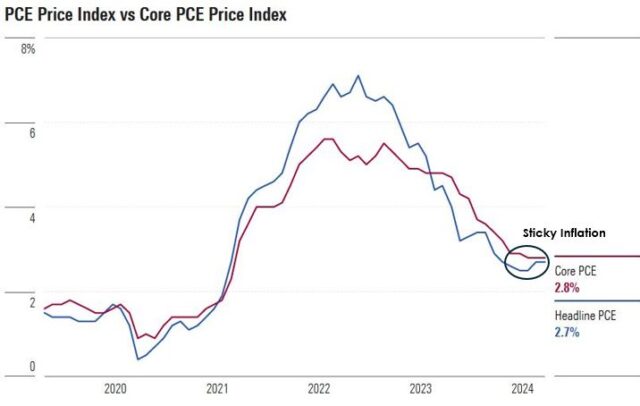

While inflation has been gradually decelerating, the Personal Consumption Expenditures (PCE) price index, a key inflation metric used by the Federal Reserve, was up 0.3% for April 2024 and 2.7% year over year. This means that inflation remains stubbornly above the Fed’s 2% target. As a result, the central bankers are likely to keep interest rates higher for longer to bring price pressures fully under control. Lowering rates too soon could let inflation stick around, so the Fed will probably keep interest rates where they see clear signs that inflation is under control.

In this ‘higher for longer’ interest rate environment investors need to play defense like a championship team protecting a lead.

Bond Investments

For now, bond investors should continue to focus on short-term bonds and floating rate funds that can benefit from higher yields without too much interest rate risk. Active bond managers who can adapt to changing conditions might be a better bet than index bond funds.

Stock Investments

For stocks, look for companies with strong balance sheets and reliable dividends. These companies can better handle high interest rates compared to heavily indebted ones. Funds that focus on value, quality, and dividends are smart choices because they invest in companies that can handle economic bumps caused by the current high rates.

Diversification

Diversification across asset classes, sectors, and investment styles is key to reducing risk. It’s like having a balanced team with a strong offense and defense. Above all, maintain discipline around your asset allocation plan based on your goals and risk tolerances. Staying diversified and rebalancing your portfolio can help during volatile times, just like keeping your cool and sticking to your strategy in the final minutes of a tight game.

Source: Morningstar and Bureau of Economic Analysis